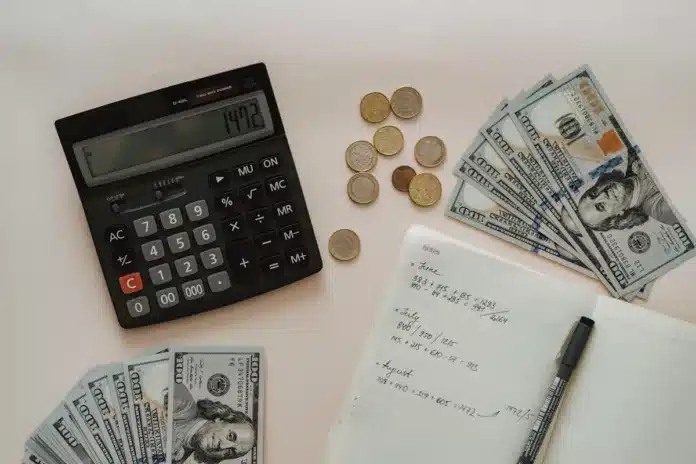

As interest rates on mortgages continue their rollercoaster ride in 2025, homebuyers and homeowners alike are watching the market closely.

With the average 30-year fixed mortgage rate at 6.26%, questions remain: Will rates drop further? Should you buy now or wait? Here’s everything you need to know about today’s mortgage landscape.

Current Mortgage Interest Rates (As of March 4, 2025)

- 30-Year Fixed: 6.26%

- 20-Year Fixed: 5.94%

- 15-Year Fixed: 5.58%

- 5/1 ARM: 6.15%

- 7/1 ARM: 6.21%

- 30-Year VA Loan: 5.72%

- 15-Year VA Loan: 5.24%

Mortgage rates have been on a slight downward trend for the past two weeks. While these rates are still high compared to pre-pandemic levels, they are better than last year’s peak of over 7%.

Why Are Mortgage Rates Holding Steady?

The Federal Reserve’s pause on rate hikes has kept mortgage rates from rising dramatically. However, inflation concerns and economic uncertainty mean the Fed is playing it safe with gradual rate adjustments. Experts predict that rates will gradually decrease throughout 2025 but likely won’t drop significantly until 2026.

Should You Buy Now or Wait?

If you’re debating whether to lock in a mortgage now or wait, here’s what to consider:

- Buy Now If: You find a good home at a reasonable price and can afford the current interest rate.

- Wait If: You’re not in a rush and expect rates to fall later in the year, potentially making your mortgage more affordable.

Fixed vs. Adjustable-Rate Mortgages (ARM): What’s Better in 2025?

- Fixed-Rate Mortgages: Offer stability and are great if you plan to stay in your home long-term.

- Adjustable-Rate Mortgages (ARMs): Typically start with lower rates but can increase after a set period. These might be a good short-term option if you plan to move within 5-7 years.

Mortgage Refinance Rates: Is Now the Time to Refinance?

For homeowners looking to lower their monthly payments, refinancing might be an option. Here’s where refinance rates stand:

- 30-Year Fixed Refinance: 6.30%

- 15-Year Fixed Refinance: 5.59%

- 5/1 ARM Refinance: 6.24%

Refinancing makes sense if you can reduce your interest rate by at least 1% or shorten your loan term without a major increase in monthly payments.

Tips to Get the Best Mortgage Rate

Want to secure the lowest possible rate? Follow these steps:

- Improve Your Credit Score: Aim for 740 or higher to get the best deals.

- Save for a Larger Down Payment: A 20% down payment can help you avoid private mortgage insurance (PMI) and reduce your rate.

- Compare Lenders: Don’t settle for the first offer—shop around for the best rate.

- Consider Discount Points: Paying points upfront can lower your interest rate over time.

What’s Next for Mortgage Rates?

While rates are holding steady, most experts predict a gradual decline in the coming months. The Federal Reserve’s decisions, inflation, and economic trends will all play a role. If you’re planning to buy a home, stay informed and lock in a rate when it makes financial sense.

Whether you’re buying a home, refinancing, or just keeping an eye on the market, mortgage rates will continue to be a key factor in 2025. Stay prepared, shop smart, and make the best decision for your financial future.

- Are Interest Rates on Mortgages Finally Dropping? What Buyers Need to Know - March 5, 2025

- Ford’s U.S. Sales Decline in February Amid Hybrid and EV Growth - March 5, 2025

- iOS 18.4 Beta 2: The Best New Features You Need to Try - March 5, 2025