The Internal Revenue Service (IRS) is facing a drastic workforce reduction, with plans to cut up to 50% of its 90,000 employees through layoffs, attrition, and buyouts, leaving many wondering whether this could further impact refunds and delays.

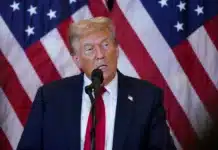

This move, part of the Trump administration’s federal workforce reduction strategy, raises serious concerns about the efficiency of tax collection, enforcement, and most urgently IRS refunds and processing times.

With tax season in full swing, many Americans are wondering: Will IRS layoffs lead to refund delays, longer wait times, and increased processing errors?

How Will IRS Layoffs Affect Refund Processing?

The IRS is responsible for processing millions of tax returns every year, issuing refunds, handling audits, and providing customer service to taxpayers. A 50% workforce reduction could significantly impact its ability to:

- Process Refunds on Time:

- Fewer employees mean longer processing times, potentially delaying refunds beyond the standard 21-day window for e-filed returns and six weeks for paper returns.

- Even minor errors on tax forms could result in extended wait times, as fewer IRS agents will be available to resolve issues.

- Respond to Taxpayer Inquiries:

- IRS helplines are already notoriously difficult to reach during tax season. Layoffs could make it even harder for taxpayers to get answers about their refunds or disputes.

- Customer service response times will likely increase, making it more frustrating for filers who need assistance.

- Handle Audits and Compliance Issues:

- With a smaller workforce, the IRS may struggle to review and verify tax filings efficiently.

- Audit rates may drop, but tax enforcement could become erratic, creating uncertainty for both businesses and individuals.

Delayed Refunds: A Growing Concern for Taxpayers

1. The “Deferred Resignation Program” & Seasonal Employees

One key issue is that IRS employees involved in the 2025 tax season cannot accept buyouts until mid-May, after the filing deadline. However, once these employees exit, backlogs in processing returns, adjustments, and appeals could spike.

2. Shift of IRS Staff to Immigration Enforcement

Reports indicate that some IRS employees may be reassigned to assist the Department of Homeland Security (DHS) with immigration enforcement efforts. This means fewer agents available to focus on tax processing and compliance, further worsening delays.

3. What This Means for Low-Income and Self-Employed Filers

Refunds are a financial lifeline for many Americans, particularly low-income earners and self-employed individuals who rely on tax credits like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC).

- If refund delays become widespread, many households may struggle with budgeting, paying off debts, or making essential purchases.

- Small business owners who depend on refunds for reinvestment may face financial strain.

What Can Taxpayers Do to Avoid Delays?

With uncertainty looming, taxpayers can take proactive steps to minimize refund delays:

- File Taxes as Early as Possible – The sooner you file, the earlier your return is processed before major backlogs occur.

- E-File and Opt for Direct Deposit – Paper filings will likely see the worst delays. E-filing with direct deposit remains the fastest refund option.

- Double-Check Your Tax Return – Small errors (like incorrect Social Security numbers or missing signatures) could lead to months-long processing delays.

- Track Your Refund Online – Use the IRS “Where’s My Refund” tool to monitor processing status.

- Plan for Longer Wait Times – If you’re counting on a refund for major expenses, be prepared for potential delays beyond the standard timeline.

What’s Next? The Uncertainty Around IRS Budget Cuts

As of now, the IRS workforce reduction is still being finalized, with reports indicating that a March 13 deadline has been set for agencies to submit their restructuring plans. However, the White House has not yet approved the full extent of the layoffs.

If these drastic cuts go through, the consequences will ripple across the tax system, affecting refund processing, customer service, compliance enforcement, and taxpayer confidence.

The big question remains: Will the federal government intervene before taxpayers feel the full impact?