Donald Trump’s administration is shaking things up again—this time with talks of shutting down the IRS.

Yep, you heard that right. U.S. Commerce Secretary Howard Lutnick just confirmed that the idea is officially on the table, and people are already losing their minds. Whether you’re cheering at the thought of fewer tax forms or sweating over what this means for the economy, one thing’s clear: this move is about to stir up a whole lot of debate.

IRS Layoffs and What Comes Next

The buzz started when reports dropped that the IRS is planning to lay off around 6,000 employees, mostly recent hires. It’s part of a bigger push to downsize the federal government, but the timing’s got everyone talking. The layoffs are raising eyebrows, especially since they hit right when Trump’s team is hinting at pulling the plug on the IRS entirely.

But don’t think this means taxes are going away. Nope. The administration is floating the idea of creating something called the “External Revenue Service” (ERS). Unlike the IRS, which deals with everything from your paycheck to your side hustle, the ERS would focus on collecting tariffs and duties from foreign companies. Basically, the plan shifts the tax burden away from regular Americans and onto international businesses—at least, that’s the pitch.

Why Kill the IRS?

So, what’s the deal with scrapping the IRS? Supporters say it’s about cutting government bloat and making taxes less of a headache. Imagine a world with no April 15th panic—no scrambling for W-2s, no confusing deductions. Sounds pretty sweet, right? Trump’s team argues that getting rid of the IRS could save billions in operating costs and make the U.S. economy more competitive by relying more on tariffs and consumption taxes.

Plus, let’s be real—the IRS isn’t exactly America’s favorite agency. From audit nightmares to complicated tax codes, most folks wouldn’t miss it. And with inflation still biting and people struggling to make ends meet, the idea of one less government hand in your wallet is pretty tempting.

But Not Everyone’s Sold

Of course, not everyone’s buying into the hype. Critics warn that axing the IRS could throw the economy into chaos. Without income taxes, the government would lose a huge chunk of its revenue—money that pays for everything from Social Security to national defense. And while tariffs on foreign goods might help fill the gap, there’s no guarantee they’d bring in enough cash to keep the country running.

Then there’s the question of fairness. Skeptics argue that relying on tariffs and consumption taxes could hit lower-income Americans harder since they spend a bigger chunk of their income on everyday goods. Meanwhile, wealthier folks might actually save money since they wouldn’t be paying income taxes.

And what about compliance? Right now, the IRS keeps people and businesses accountable, making sure everyone pays their fair share. Without it, some worry tax evasion could skyrocket, leaving the government struggling to fund essential services.

Businesses Are Watching Closely

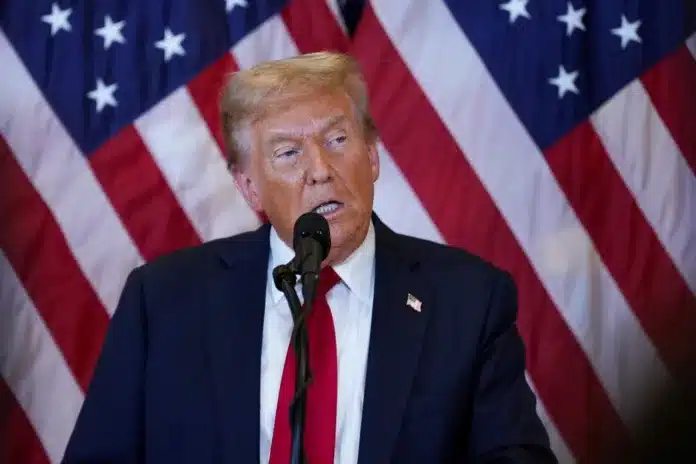

BREAKING: Commerce Secretary Lutnick just confirmed that the Trump Administration is looking to ABOLISH the IRS!

This is not a drill!

Let's get it done! pic.twitter.com/9XdMIkYu2q

— Gunther Eagleman™ (@GuntherEagleman) February 20, 2025

Corporate America is paying close attention, too. On one hand, businesses could benefit from lower taxes and fewer regulations. But companies that rely on imports might get slammed by higher tariffs, which could drive up prices for consumers. And if the government can’t collect enough revenue through tariffs, there’s always the risk that businesses could end up footing the bill through other means.

What Happens Next?

So, is the IRS really about to vanish? It’s too soon to say. The idea still has to get through Congress, where opinions are all over the map. Some lawmakers are all in, seeing this as a chance to simplify taxes and boost the economy. Others are digging in their heels, warning that the plan could blow a hole in the federal budget and leave essential programs underfunded.

One thing’s for sure—this debate is just getting started. Whether you’re rooting for a future without tax season or worried about what comes next, buckle up. Trump’s IRS abolition plan is about to be one of the hottest topics in Washington.

- Trump’s Shocking Plan to Abolish the IRS – What Happens to Your Taxes & Refunds? - February 20, 2025

- Apple’s iPhone 16e Is Fast, Smart & Affordable – What’s the Catch? - February 19, 2025

- Is Hims & Hers Stock the Next Big Money Maker? - February 19, 2025