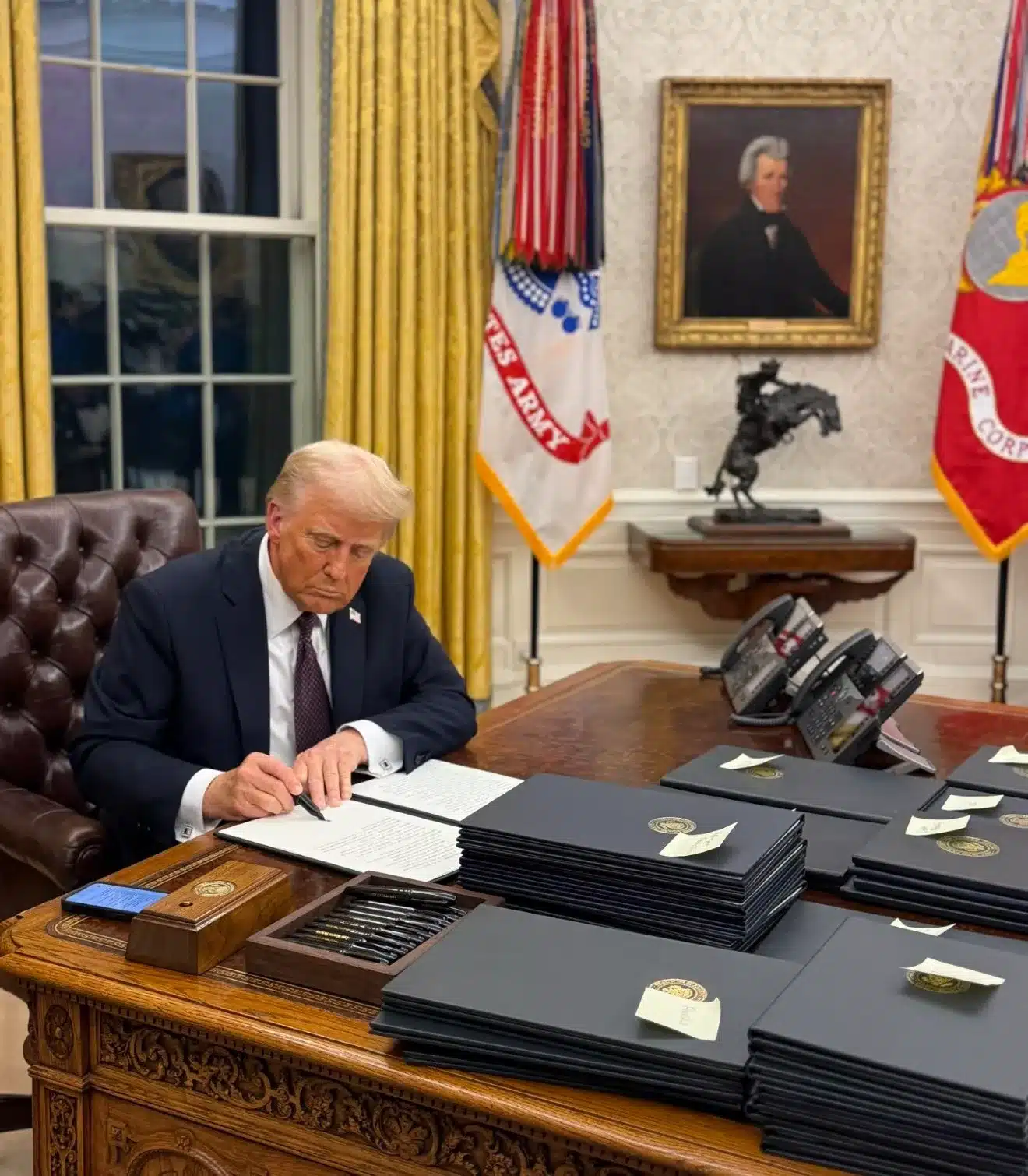

President Donald Trump is proposing a radical tax policy that could eliminate federal income taxes for individuals earning less than $150,000 per year.

U.S. Commerce Secretary Howard Lutnick confirmed the plan, suggesting it could completely change how the government collects revenue. If implemented, millions of Americans would keep significantly more of their income.

This proposal comes as Trump’s 2017 tax cuts near expiration. With tax policy expected to be a major election issue, the administration is considering alternatives to traditional income taxes. Instead of taxing individuals, Trump’s plan would shift the burden to external sources, such as imposing a “membership fee” on other countries that trade with the U.S. The idea is to replace internal tax revenue with external contributions, reducing the financial pressure on American workers.

For middle-class earners, this could mean thousands of dollars in savings each year. According to current tax brackets, someone earning $100,000 pays roughly $15,000 in federal income taxes. Under this plan, they could take home that entire amount, leading to a significant boost in personal finances. Supporters argue that this would increase spending, stimulate the economy, and improve financial security for millions.

However, critics are raising concerns about how the government would replace such a massive source of revenue. In 2023, federal income taxes accounted for nearly half of all government funds. Without clear alternative funding, skeptics worry that vital services such as Social Security, Medicare, and defense could be underfunded. Others warn that shifting the tax burden to international trade could trigger economic retaliation, leading to increased costs for goods and services in the U.S.

The proposal also faces political hurdles. While Trump’s allies are pushing for major tax reforms, getting Congress to approve such a drastic change won’t be easy.

🚨BREAKING: Commerce Secretary Howard Lutnick says President Trump wants no taxes for people who make less than $150,000 a year.

pic.twitter.com/J1COS3sMxm— Benny Johnson (@bennyjohnson) March 13, 2025

Lawmakers on both sides will scrutinize the plan’s feasibility and impact on the economy. Some expect that even if the proposal doesn’t pass in its entirety, a modified version could be introduced to reduce tax burdens on middle-class Americans.

With tax season in full swing, millions are paying close attention. If this plan gains traction, it could be one of the biggest tax policy shifts in U.S. history. Trump’s team is expected to release more details soon, and as the election draws closer, this proposal could become a major talking point in debates over economic policy.

- Millions Could Pay Zero Income Tax Under Trump’s New Plan - March 13, 2025

- More Stores Closing: Joann Ends Gift Card Use as Retail Shutdown Continues - March 13, 2025

- Fires, Power Outages Hit Texas Tech After Lubbock Explosion - March 13, 2025