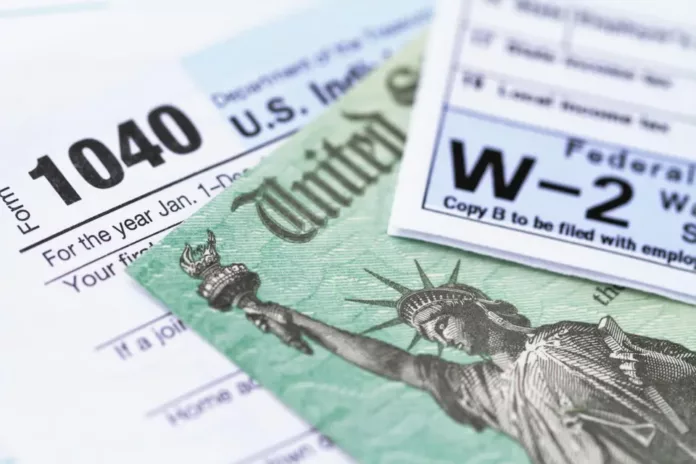

If you never received your $1,400 stimulus check, time is running out to claim it, the IRS is still sending payments to eligible taxpayers who missed out on the final round of Covid-19 relief, but you must act before April 15, 2025.

Millions of Americans never filed a tax return for 2021, leaving money on the table. If you’re one of them, you could still qualify for the Recovery Rebate Credit, which ensures you receive the stimulus payment you were entitled to.

Who Qualifies for the $1,400 Stimulus Check?

The stimulus checks, issued under the American Rescue Plan Act of 2021, provided up to $1,400 per person based on income eligibility.

Here’s who qualifies for the full amount:

- Single filers: Earned $75,000 or less in 2021 (phases out completely at $80,000)

- Married couples filing jointly: Earned $150,000 or less (phases out completely at $160,000)

- Dependents: Each qualifying dependent in 2021 is eligible for an additional $1,400, subject to the same income limits as the primary filer

If your income in 2021 was higher than these thresholds, your stimulus amount was reduced or phased out entirely.

How to Claim Your $1,400 Stimulus Check

If you never received your check, here’s how to claim it:

- File a 2021 tax return by April 15, 2025. Even if you weren’t required to file taxes that year, submitting a return is the only way to receive the money.

- Check your eligibility with the Recovery Rebate Credit. The credit ensures you receive any stimulus payments you were entitled to but never got.

- Use direct deposit for faster payment. The IRS will automatically deposit your stimulus check if you provide banking information on your 2023 tax return. If not, a paper check will be mailed.

Why Some People Are Getting Automatic Payments

The IRS has been sending payments to taxpayers automatically, but not everyone is covered. If you previously filed a return with blank or incorrect Recovery Rebate Credit data, the IRS may have corrected it and issued your check.

However, if you never filed for 2021, the IRS won’t send you anything unless you submit a return before the deadline.

Deadline Alert – Act Before April 15, 2025

The IRS only allows refunds or credits to be claimed within three years, meaning the final cutoff to claim your missed stimulus check is April 15, 2025.

Once that date passes, you lose the chance to get your money, even if you were eligible.

Don’t Miss Out on Free Money

If you never received your $1,400 stimulus check, now is the time to claim it. Filing a 2021 tax return is the only way to get the money before it’s gone forever.

Check your eligibility, file before April 15, 2025, and ensure you receive what you’re owed.

- Government Shutdown 2025: Congress Battles to Avoid Crisis - March 10, 2025

- You Can Still Claim a $1,400 Stimulus Check From the IRS – Here’s How - March 10, 2025

- Social Security’s New Policy Could Leave You With $0 – Here’s What to Do - March 10, 2025