Best States to Buy a Home in 2025

Buying a home is a major financial decision, and choosing the best states to buy a home in 2025, matters quite a bit.

Housing markets vary widely across the U.S., with factors like affordability, job opportunities, and quality of life influencing homebuyers’ choices. In 2025, certain states stand out as attractive options due to reasonable home prices, strong economies, and potential for property value appreciation.

Real Estate Market Trends in 2025

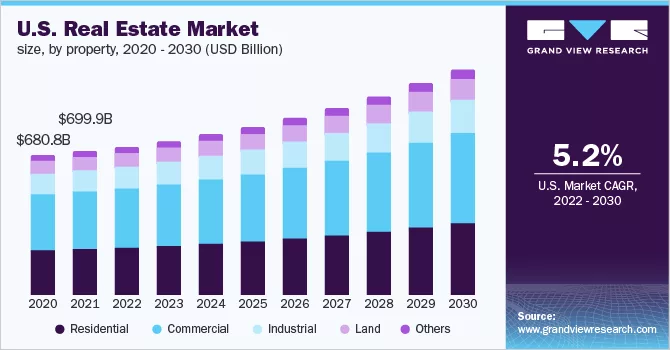

The housing market has seen fluctuations in recent years, according to Grand View Research. Following rapid price increases from 2020 to 2022, rising mortgage rates led to stabilization in 2024. While home prices remain high in some areas, demand is shifting toward states with more affordable housing and job growth. Population migration trends continue, with many buyers leaving expensive coastal states for more budget-friendly inland regions. States with strong economies, lower property taxes, and a high quality of life are seeing increased demand.

1. Texas

Why Buy in Texas?

Texas remains a top choice for homebuyers due to its booming economy, no state income tax, and relatively affordable housing. Cities like Austin, Dallas-Fort Worth, San Antonio, and Houston offer diverse options.

- Affordability: Median home prices in many Texas cities remain around $300,000.

- Economic Growth: Texas is a leader in technology, energy, and healthcare industries.

- Diverse Housing Options: From urban high-rises to suburban homes and new developments.

- Considerations: High property taxes can impact affordability.

Houston, in particular, remains an attractive market with spacious homes below the national median price, while Austin continues to draw tech professionals despite higher home costs.

2. Florida

Why Buy in Florida?

Florida attracts both retirees and young professionals thanks to its thriving economy, warm climate, and no state income tax.

- Affordable Cities: Tampa, Orlando, and Jacksonville offer reasonable home prices compared to Miami and Naples.

- Strong Job Market: Tourism, healthcare, and finance sectors are driving employment growth.

- Lifestyle Perks: Beaches, entertainment, and year-round warm weather.

- Considerations: Higher insurance costs due to hurricanes.

Tampa Bay and Jacksonville are among the most affordable metro areas in Florida, offering a mix of urban and suburban living.

3. North Carolina

Why Buy in North Carolina?

North Carolina’s blend of affordability, economic growth, and lifestyle appeal makes it a top choice.

- Booming Tech & Finance Hubs: Raleigh-Durham and Charlotte offer high-paying jobs with lower housing costs compared to other tech hubs.

- Affordable Housing: Many cities have median home prices below the national average.

- Quality of Life: Mountains, beaches, and a moderate climate.

- Considerations: Property taxes are moderate but vary by location.

Raleigh’s Research Triangle and Charlotte’s banking sector make these cities prime investment areas, while Greensboro and Winston-Salem offer even lower housing costs.

4. Georgia

Why Buy in Georgia?

Georgia, especially the Atlanta metro area, is a growing economic hub.

- Affordable Housing: Suburban areas like Clayton and DeKalb Counties offer homes under $300,000.

- Job Market: Major companies like Coca-Cola, Delta, and Home Depot are headquartered in Atlanta.

- Cost of Living: Slightly below the national average.

- Considerations: Atlanta traffic can be challenging.

Savannah and Augusta also present great opportunities for affordable homeownership with strong job markets and lower living costs.

5. Arizona

Why Buy in Arizona?

Arizona offers a strong housing market, particularly in Phoenix and its suburbs.

- Affordable New Construction: Many newly built homes remain within budget.

- Growing Economy: Tech, healthcare, and tourism sectors are expanding.

- Mild Winters: Great for retirees looking for warm weather.

- Considerations: Intense summer heat and long-term water concerns.

Phoenix, Tucson, and Mesa continue to attract homebuyers, especially those relocating from expensive states like California.

Honorable Mentions

- Ohio: Cities like Cleveland, Columbus, and Cincinnati offer homes well below the national median price.

- Missouri: Kansas City and St. Louis provide affordable housing with strong job markets.

- Pennsylvania: Pittsburgh has low home prices and a growing tech and healthcare sector.

- Michigan: Detroit’s revitalization and smaller cities like Grand Rapids offer budget-friendly options.

States for Cautious Consideration

While some states remain desirable, high costs can be a challenge for buyers in:

- California: Extremely high median home prices, though Central Valley is more affordable.

- New York: Expensive markets like NYC, but upstate areas are cheaper.

- Massachusetts & Washington: High demand and cost make homeownership challenging.

In 2025, the best states for buying a home offer affordability, economic stability, and long-term growth potential. Texas, Florida, North Carolina, Georgia, and Arizona stand out, each with unique benefits. As migration trends continue, these states remain attractive for homebuyers seeking value and quality of life. Buyers should research specific metro areas within these states to find the best fit for their budget and lifestyle. With careful planning, 2025 could be an excellent year to secure a home in one of these promising markets.

- Dairy Queen Is Handing Out Free Cones Today – Don’t Miss Out! - March 20, 2025

- Surprise Artists with Flowers in UAE: Find the Perfect Flower Shop - March 20, 2025

- Buying a Home in the U.S.? These Are the Best States to Invest in 2025 - March 20, 2025