Wealth can be fleeting, even for the world’s richest. History is filled with shocking stories of billionaires who lost it all overnight due to market crashes, fraud, legal troubles, or bad investments.

Here’s a look at eight high-profile billionaires whose fortunes vanished in the blink of an eye.

8. Vijay Mallya – The King of Bad Debts

Vijay Mallya, once India’s richest liquor baron and owner of Kingfisher Airlines, lost his fortune when his airline accumulated over $1 billion in debt. Despite his success with the Kingfisher brand, financial mismanagement and mounting losses led to the airline’s collapse in 2012. As a result, Mallya owed massive sums to Indian banks, but when he fled the country to escape creditors, the banks pursued him relentlessly. Now facing legal battles, including an extradition request from India for financial crimes, Mallya’s lavish lifestyle came to an abrupt end, leaving him embroiled in ongoing legal and financial troubles. Source – Love Food

7. Björgólfur Guðmundsson – Icelandic Banking Crisis

Bjorgolfur Gudmundsson, a former soccer player turned billionaire, lost his fortune after the 2008 Icelandic banking crisis. Having invested heavily in the beverage industry, West Ham United, and Landsbanki, his empire crumbled when the bank collapsed, leaving him with massive debts. In addition to the financial losses, Gudmundsson faced charges for bookkeeping offences, further draining his resources as he fought legal battles. By 2009, unable to pay his debts, he was declared bankrupt, losing his $3.5 billion net worth and the assets that had once made him one of Iceland’s wealthiest individuals. Source – Love Food

6. Elizabeth Holmes – Theranos Fraud

Elizabeth Holmes, once a celebrated Silicon Valley entrepreneur, lost everything due to her fraudulent claims with Theranos. Promising to revolutionize blood testing, her company misled investors and patients, leading to a series of legal battles. Despite her $9 billion valuation and high-profile backers, whistleblowers exposed the company’s malfunctioning technology. Holmes was convicted of wire fraud and conspiracy, sentenced to over 11 years in prison, and Theranos was shut down. The downfall of her empire serves as a cautionary tale about the dangers of overpromising in tech startups and the importance of ethical leadership. Source – EQS

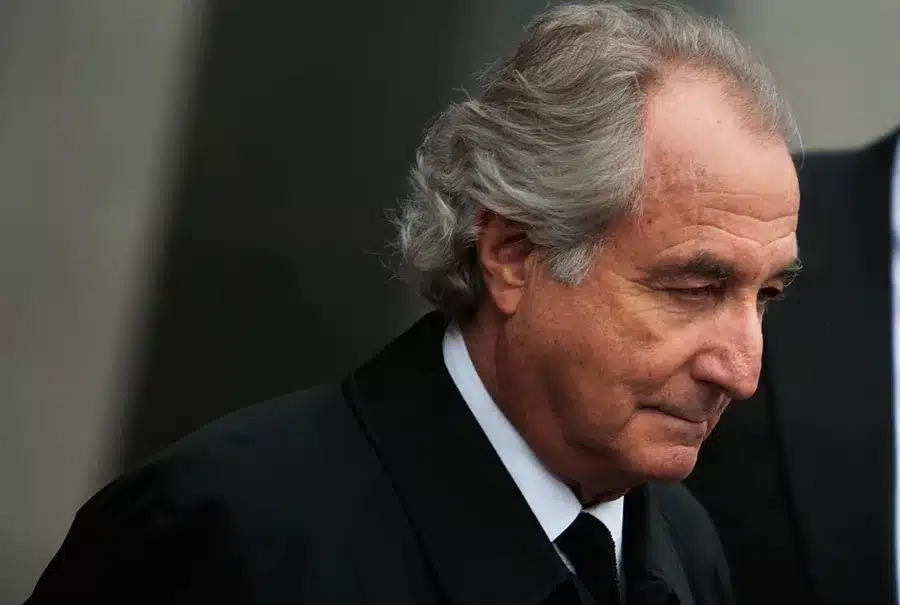

5. Bernard Madoff – The Largest Ponzi Scheme in History

Bernie Madoff lost it all after orchestrating the largest Ponzi scheme in history, defrauding investors of an estimated $65 billion. For decades, Madoff promised high returns, using new investors’ money to pay existing clients and fund his lavish lifestyle. The scheme unraveled during the 2008 financial crisis, when Madoff couldn’t meet withdrawal requests. His sons discovered the fraud and reported him to authorities. In 2009, Madoff was sentenced to 150 years in prison. His assets were seized, but only a fraction of the stolen funds was returned to victims. Madoff died in prison in 2021. Source – Investopidia

4. Allen Stanford – Ponzi Scheme Scandal

Allen Stanford, once a billionaire and one of America’s wealthiest men, lost everything after his involvement in a $7 billion Ponzi scheme. As the founder of Stanford International Bank in Antigua, Stanford sold fraudulent certificates of deposit, deceiving 50,000 investors. His lavish lifestyle, funded by these deceptive investments, included private jets and yachts. However, his empire crumbled when the SEC charged him in 2009, and he was convicted in 2012, receiving a 110-year prison sentence. Stanford’s downfall also severely impacted Antigua, where he was the largest employer, causing widespread economic distress. Source – Investopidia

3. Adolf Merckle – A Tragic Downfall

Adolf Merckle, once worth over $9 billion, lost everything due to a disastrous bet on Volkswagen shares and the global financial crisis. His empire, which controlled HeidelbergCement, Ratiopharm, and Phoenix Pharma, crumbled under mounting debt. The Volkswagen stock gamble cost him billions, forcing him to seek emergency loans from over 30 banks. As financial pressure mounted and negotiations dragged on, Merckle, overwhelmed by powerlessness, tragically took his own life in 2009. His downfall serves as a cautionary tale of high-risk investments and the devastating impact of financial crises on even the most successful business empires. Source – The Economic Times

2. Sam Bankman-Fried – The FTX Crypto Collapse

Sam Bankman-Fried, once hailed as the “king of crypto,” lost it all when FTX, his $32 billion exchange, collapsed in a matter of days. A leaked report exposed the shaky financials of his trading firm, Alameda Research, triggering mass withdrawals. As FTX scrambled for a bailout, its token, FTT, plummeted, and billions vanished. Accused of misusing customer funds, SBF now faces criminal charges and investigations by the DOJ and SEC. Once a major donor and philanthropist, his meteoric rise has ended in disgrace, leaving customers, investors, and the crypto world reeling from one of the biggest financial scandals ever. Source – Vox

1. Eike Batista – From Oil Tycoon to Bankrupt

Eike Batista, once Brazil’s richest man with a $30 billion fortune, lost it all when his oil company OGX collapsed in 2013. His empire was built on overhyped oil reserves and unrealistic promises, attracting eager investors. As production failed to meet expectations, stock values plummeted, wiping out his wealth. Batista’s reliance on debt financing for risky ventures proved disastrous.

His lavish lifestyle and controversial public persona fueled public backlash. When Brazil’s economy slowed, state-run banks withdrew support, sealing his downfall. Now, burdened with over $800 million in debt, Batista stands as a cautionary tale of financial overreach and misplaced confidence. Source – Los Angeles Times

Lessons from These Billionaire Falls

These stories prove that even the wealthiest individuals are not immune to financial disasters. Whether due to fraud, risky investments, or economic downturns, these billionaires lost fortunes overnight. Their experiences serve as cautionary tales for entrepreneurs and investors alike.

Stay Informed and Avoid Financial Pitfalls

Want to learn more about financial successes and failures? Follow our latest updates on business trends, investment strategies, and economic news. Stay ahead of the game by understanding what makes and breaks fortunes.

Who do you think had the most shocking fall from wealth? Share your thoughts in the comments and subscribe for more financial insights!

- How to Blur Your House on Google Maps Before Criminals Spot It - July 2, 2025

- Tired of $100 Internet Bills? Here’s How to Lower Yours in 2025 - June 26, 2025

- Top 150 Father’s Day Wishes, Quotes & Messages to Make Dad Smile - June 15, 2025